Financial Statement Analysis Explained in details for BCA | BBA | MBA | MCA

Explore the fundamentals of financial statement analysis, its objectives, and the different types of financial statements. Learn how to perform ratio analysis and understand its advantages and limitations.

Introduction to Financial Statement Analysis

What Is Financial Statement Analysis? An Overview

Financial Statement Analysis is like a health check-up for a company. Just as doctors look at different tests and reports to understand a person's health, financial analysts look at financial statements to understand a company's financial health. These statements include the Balance Sheet, Income Statement, and Cash Flow Statement. By examining these documents, we can figure out how well the company is doing, where it's making money, and where it might need to improve.

Example: Imagine you have a lemonade stand. At the end of the month, you write down how much money you made from selling lemonade (Income Statement), how much money you have saved in your piggy bank (Balance Sheet), and how much money you spent on buying lemons and sugar (Cash Flow Statement). This is your own mini-financial statement analysis.

What are the Objectives of Financial Statement Analysis?

The main Objectives of Financial Statement Analysis are to:

- Assess Financial Health: Just like we check our savings and expenses to see if we are financially stable, companies use financial statement analysis to check their financial stability. For example, a company with more assets than liabilities is considered financially healthy.

- Make Informed Decisions: Business owners, investors, and managers use this analysis to make smart decisions. For example, if a company wants to expand, they can use financial statement analysis to see if they have enough money to do so.

- Identify Trends: By comparing financial statements from different periods, we can see if a company is improving or declining. For example, if a company’s profit is increasing every year, it indicates positive growth.

- Compare with Competitors: Just like we compare prices and quality before buying something, companies compare their financial statements with competitors to see where they stand in the market.

Key Takeaways from Financial Statement Analysis

When you analyze financial statements, here are some important things to remember:

- Understanding Financial Statements: Knowing how to read and understand the balance sheet, income statement, and cash flow statement is crucial.

- Financial Ratios: These are simple calculations that help us understand a company's performance. For example, the current ratio (current assets divided by current liabilities) tells us if a company can pay its short-term debts. If a company has ₹1,00,000 in current assets and ₹50,000 in current liabilities, the current ratio is 2 (₹1,00,000/₹50,000), meaning the company can easily pay its short-term debts.

- Decision Making: Financial statement analysis helps in making important business decisions, like whether to invest in a company or expand a business.

- Identifying Strengths and Weaknesses: It helps in pinpointing what a company is doing well and where it needs improvement. For example, if a company has high sales but low profits, it might need to control its expenses better.

- Planning and Forecasting: Companies use this analysis to plan for the future. For example, if a company sees that its profits are steadily increasing, it might plan to open new branches.

By understanding and using financial statement analysis, businesses can ensure they are on the right track and make informed decisions that help them grow and succeed.

Meaning and Steps of Ratio Analysis

Meaning of Ratio Analysis in Financial Statement Analysis

What is Ratio Analysis?

Ratio analysis is a way to understand a company's financial health by comparing different numbers from its financial statements. Think of it as checking your own health by comparing things like your weight, height, and age to see if you're healthy.

Why is Ratio Analysis Important?

Just like you use different measures to check your health, businesses use ratio analysis to check their financial health. It helps investors, managers, and other stakeholders make informed decisions.

Ratio analysis is a powerful tool for understanding a company's financial health. By comparing different financial numbers, you can get a clear picture of how well a company is doing. Whether you're an investor, a manager, or just curious, ratio analysis helps you make better financial decisions.

Steps in Ratio Analysis: A Detailed Guide

These are the steps to perform ratio analysis:

Step 1: Collect Financial Statements

Get the company's financial statements like the balance sheet and income statement. For example, let's look at ABC Pvt Ltd's balance sheet and income statement for the year 2023.

Step 2: Choose the Ratios to Calculate

Decide which ratios you want to calculate. Common ratios include:

- Liquidity Ratios (e.g., Current Ratio)

- Profitability Ratios (e.g., Net Profit Margin)

- Efficiency Ratios (e.g., Inventory Turnover)

- Solvency Ratios (e.g., Debt to Equity Ratio)

Step 3: Calculate the Ratios

Use formulas to calculate the chosen ratios. Here are a few examples:

1. Current Ratio: Measures if the company can pay its short-term debts.

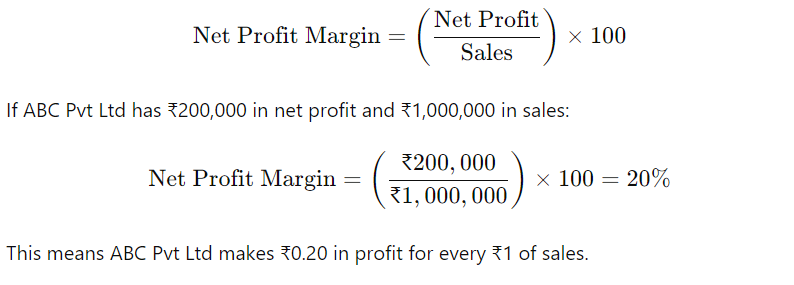

2. Net Profit Margin: This shows how much profit the company makes for every rupee of sales.

3. Debt to Equity Ratio: Indicates how much debt the company has compared to its equity.

Step 4: Analyze the Results

Compare the calculated ratios to industry averages or past performance to see if the company is doing well. For example, if the average current ratio in the industry is 1.5 and ABC Pvt Ltd has 2, it means the company is better at paying short-term debts than its competitors.

Step 5: Make Decisions

Use the ratio analysis to make informed decisions. For example, if the debt-to-equity ratio is low, it might be a good time to take on more debt for expansion. If the net profit margin is high, consider reinvesting profits into the business.

How to Analyze Financial Statements Using Ratios

Analyzing financial statements using ratios helps you understand a company's performance and financial health. These are the steps to Analyze Financial Statements Using Ratios

Step 1: Understand the Financial Statements

Financial statements include the balance sheet, income statement, and cash flow statement. They provide all the numbers you need for ratio analysis.

Step 2: Identify Key Ratios

Different ratios give insights into various aspects of the company:

- Liquidity Ratios (e.g., Current Ratio, Quick Ratio)

- Profitability Ratios (e.g., Net Profit Margin, Return on Assets)

- Efficiency Ratios (e.g., Inventory Turnover, Receivables Turnover)

- Solvency Ratios (e.g., Debt to Equity Ratio, Interest Coverage Ratio)

Step 3: Calculate the Ratios

Use the financial statements to calculate the ratios. Here are some examples:

1. Quick Ratio: Measures the company's ability to pay short-term liabilities without selling inventory.

2. Return on Assets (ROA): Shows how efficiently the company uses its assets to generate profit.

3. Interest Coverage Ratio: Measures how easily the company can pay interest on its debt.

Step 4: Interpret the Ratios

Compare the calculated ratios to industry standards or historical data. For instance, a high ROA compared to industry standards indicates efficient asset use. A low quick ratio may signal liquidity issues.

Step 5: Make Informed Decisions

Use the insights gained from ratio analysis to make strategic business decisions. For example, if the interest coverage ratio is high, the company can safely consider taking on more debt. If the quick ratio is low, it may need to improve its cash flow or reduce short-term liabilities.

Classification of Ratios

Types of Ratios in Financial Statement Analysis

Ratios are simple calculations that help us understand different aspects of a company’s financial health. Think of them as shortcuts to get a quick overview of how well a business is doing.

Types of Ratios

1. Liquidity Ratios:

- Current Ratio: This ratio tells us if the company can pay its short-term debts with its short-term assets.

- Example: If a company has ₹1,00,000 in current assets and ₹50,000 in current liabilities, the current ratio is 2:1. This means the company has ₹2 for every ₹1 of debt.

2. Profitability Ratios:

- Net Profit Margin: This ratio shows how much profit a company makes after all expenses.

- Example: If a company makes ₹10,00,000 in sales and has a net profit of ₹1,00,000, the net profit margin is 10%. This means the company keeps ₹10 from every ₹100 of sales.

3. Efficiency Ratios:

- Inventory Turnover Ratio: This ratio measures how often a company sells and replaces its stock of goods.

- Example: If a store has an average inventory of ₹1,00,000 and sells goods worth ₹5,00,000 in a year, the inventory turnover ratio is 5. This means the store sold and replaced its inventory 5 times in that year.

4. Leverage Ratios:

- Debt to Equity Ratio: This ratio shows how much debt a company has compared to its equity.

- Example: If a company has ₹5,00,000 in debt and ₹10,00,000 in equity, the debt-to-equity ratio is 0.5. This means the company has ₹0.50 in debt for every ₹1 of equity.

Understanding these ratios helps investors, managers, and other stakeholders make better decisions. They provide a quick snapshot of the company’s financial health and performance.

Balance Sheet Ratio Analysis: Key Indicators

Balance sheet ratios help us understand a company’s financial position at a specific point in time. They focus on the company’s assets, liabilities, and equity.

Key Indicators:

1. Current Ratio:

- Formula: Current Assets / Current Liabilities

- Example: A company with ₹2,00,000 in current assets and ₹1,00,000 in current liabilities has a current ratio of 2. This means it can cover its short-term debts twice over with its short-term assets.

2. Quick Ratio (Acid-Test Ratio):

- Formula: (Current Assets - Inventory) / Current Liabilities

- Example: If a company has ₹2,00,000 in current assets, ₹50,000 in inventory, and ₹1,00,000 in current liabilities, the quick ratio is 1.5. This means the company has ₹1.50 in liquid assets for every ₹1 of short-term debt.

3. Debt to Equity Ratio:

- Formula: Total Debt / Shareholders' Equity

- Example: A company with ₹5,00,000 in total debt and ₹10,00,000 in shareholders' equity has a debt-to-equity ratio of 0.5. This shows the company uses ₹0.50 of debt for every ₹1 of equity.

4. Return on Equity (ROE):

- Formula: Net Income / Shareholders' Equity

- Example: If a company has a net income of ₹1,00,000 and shareholders' equity of ₹5,00,000, the ROE is 20%. This means the company generated a 20% return on the equity invested by the shareholders.

Balance sheet ratios are crucial for evaluating a company’s financial stability and efficiency. They help in understanding how well the company manages its resources and obligations. By analyzing these ratios, stakeholders can make informed decisions about investing in or managing the company.

Profit and Loss Account Ratio Analysis: What to Look For

When you analyze the Profit and Loss (P&L) account ratios, you can understand how well a business is doing. These ratios tell you about the company's revenue, expenses, and profits. Here's how to look at them:

1. Gross Profit Ratio

- Formula: Gross Profit / Net Sales

- Example: If a company sells goods worth ₹10,00,000 and the cost of these goods is ₹6,00,000, the gross profit is ₹4,00,000. The Gross Profit Ratio is (₹4,00,000 / ₹10,00,000) * 100 = 40%.

- What to Look For: A higher ratio means the company is making a good profit from its sales.

2. Net Profit Ratio

- Formula: Net Profit / Net Sales

- Example: If the net profit is ₹2,00,000 on sales of ₹10,00,000, the Net Profit Ratio is (₹2,00,000 / ₹10,00,000) * 100 = 20%.

- What to Look For: A higher ratio shows the company is managing its expenses well and retaining more profit.

3. Operating Profit Ratio

- Formula: Operating Profit / Net Sales

- Example: If the operating profit is ₹3,00,000 on sales of ₹10,00,000, the Operating Profit Ratio is (₹3,00,000 / ₹10,00,000) * 100 = 30%.

- What to Look For: This ratio indicates how well the company controls its operating costs.

4. Return on Sales (ROS)

- Formula: Net Income / Net Sales

- Example: If the net income is ₹1,50,000 on sales of ₹10,00,000, the ROS is (₹1,50,000 / ₹10,00,000) * 100 = 15%.

- What to Look For: This ratio shows the percentage of sales that turns into profit.

Key Points to Remember:

- Always compare these ratios over different periods to spot trends.

- Compare these ratios with other companies in the same industry for a better understanding.

Combined Ratio Analysis: Integrating Financial Metrics

Combined Ratio Analysis means looking at multiple financial ratios together to get a full picture of a company's financial health. Here's how to do it:

1. Liquidity Ratios + Profitability Ratios

- Example: Check the Current Ratio (Current Assets / Current Liabilities) along with the Net Profit Ratio.

- What to Look For: A company might be profitable but still struggle to pay its short-term bills. Both ratios give a better overall picture.

2. Efficiency Ratios + Leverage Ratios

- Example: Look at Inventory Turnover (Cost of Goods Sold / Average Inventory) and Debt to debt-to-equity ratio (Total Debt / Total Equity).

- What to Look For: High inventory turnover with a manageable debt level shows the company efficiently manages its inventory and finances.

3. Combined Ratio for Insurance Companies

- Formula: (Incurred Losses + Expenses) / Earned Premium

- Example: If an insurance company has incurred losses of ₹5,00,000, expenses of ₹2,00,000, and earned premiums of ₹10,00,000, the Combined Ratio is (₹5,00,000 + ₹2,00,000) / ₹10,00,000 = 70%.

- What to Look For: A ratio below 100% means the company is making an underwriting profit.

4. Growth Ratios + Valuation Ratios

- Example: Combine the Earnings Per Share (EPS) growth rate with the Price to Earnings (P/E) ratio.

- What to Look For: High EPS growth with a reasonable P/E ratio suggests a potentially good investment.

Key Points to Remember:

- Combining different ratios gives a complete view of a company’s performance.

- Look at how these ratios interact with each other to understand the overall health of the business.

- Use real-world examples to see how these ratios apply in practical scenarios.

By using these simple methods, you can better analyze and understand the financial health of any business, making informed decisions based on clear and comprehensive data.

Advantages and Limitations of Ratio Analysis

Advantages of Ratio Analysis in Financial Accounting

These are the Advantages of Ratio Analysis in Financial Accounting

1. Simplifies Financial Data:

Example: Imagine you own a small shop selling clothes. You have many numbers in your sales records, expenses, and profits. Ratio analysis helps simplify these numbers. For instance, you can calculate the profit margin ratio, which tells you how much profit you make for every rupee of sales.

2. Helps in Decision Making:

Example: If you run a business, you need to decide whether to buy new equipment. Using ratio analysis, you can check your current ratio (current assets divided by current liabilities). If the ratio is high, it means you have enough money to invest in new equipment.

3. Identifies Trends Over Time:

Example: You can use ratio analysis to compare your business's financial performance over the last few years. For instance, if your debt-to-equity ratio (total debt divided by total equity) is increasing, it means your business is taking on more debt compared to its own money. This trend can help you make future financial plans.

4. Benchmarks Against Competitors:

Example: If you want to see how your shop is doing compared to other shops, you can use ratio analysis. For example, you can compare your inventory turnover ratio (cost of goods sold divided by average inventory) with other shops. A higher ratio means you sell your inventory quickly, which is good.

5. Highlights Financial Strengths and Weaknesses:

Example: If your business has a high return on assets ratio (net income divided by total assets), it means you are using your assets efficiently to make profits. On the other hand, a low ratio can highlight areas where you need to improve.

Limitations of Ratio Analysis and How to Overcome Them

These are some Disadvantages of Ratio Analysis in Financial Accounting

1. Ignores Market Conditions:

Example: Ratio analysis might show that your business has a good profit margin. However, it doesn't account for a sudden increase in raw material prices due to market conditions. Always consider external factors when analyzing ratios.

2. Based on Historical Data:

Example: Ratios use past financial data. If your business had an exceptional year last year, the ratios might not reflect current performance accurately. Update your analysis regularly to stay relevant.

3. Different Accounting Practices:

Example: If you compare your business ratios with a competitor, remember that different accounting methods can affect the results. Ensure you are comparing apples to apples by understanding the accounting practices used.

4. Doesn't Show Detailed Reasons:

Example: A low current ratio might indicate potential liquidity issues, but it doesn't explain why. It could be due to slow-moving inventory or delayed payments from customers. Investigate further to understand the root cause.

5. Potential for Manipulation:

Example: Businesses might manipulate ratios to show better performance, such as delaying expenses to improve profit margins. Always look at the full financial picture and not just the ratios.

How to Overcome These Limitations of Ratio Analysis

1. Combine with Other Analysis Tools:

Use ratio analysis along with other tools like trend analysis and cash flow analysis for a comprehensive view.

2. Regular Updates:

Update your ratio analysis regularly to reflect current financial conditions.

3. Understand the Context:

Always consider market conditions, accounting practices, and other external factors when analyzing ratios.

4. Investigate Further:

If a ratio shows an issue, investigate the underlying reasons before making decisions.

By understanding both the advantages and limitations of ratio analysis, you can make informed financial decisions and better manage your business finances.

Computation of Ratio

How to Compute Ratios: Step-by-Step Problems and Solutions

These are the Basic Steps in Ratio Analysis

Step 1: Collect Financial Statements

Gather the company's balance sheet and income statement. These statements provide the numbers needed for ratio analysis.

Step 2: Identify Key Figures

Look for figures like total assets, total liabilities, net sales, and net profit. These will be used in the calculations.

Step 3: Choose Ratios to Calculate

Decide which ratios you want to compute. Common ratios include the current ratio, debt-to-equity ratio, and net profit margin.

Step 4: Plug in the Numbers

Use the figures from the financial statements to calculate the ratios.

Step 5: Interpret the Results

Compare the results to industry standards or historical data to see how the company is doing.

Example Problem:

Company XYZ's Financial Figures:

- Total Assets: ₹50,00,000

- Total Liabilities: ₹20,00,000

- Net Sales: ₹30,00,000

- Net Profit: ₹3,00,000

Calculate the Current Ratio:

- Formula: Current Ratio = Total Assets / Total Liabilities

- Calculation: Current Ratio = ₹50,00,000 / ₹20,00,000 = 2.5

- Interpretation: A current ratio of 2.5 means the company has ₹2.50 in assets for every ₹1 in liabilities. This suggests good financial health.

Calculate the Net Profit Margin:

- Formula: Net Profit Margin = (Net Profit / Net Sales) * 100

- Calculation: Net Profit Margin = (₹3,00,000 / ₹30,00,000) * 100 = 10%

- Interpretation: A 10% net profit margin means the company earns ₹0.10 for every ₹1 in sales.

Practical Examples of Ratio Analysis in Financial Statements

Example 1: Calculating the Debt-to-Equity Ratio

Company ABC's Financial Figures:

- Total Debt: ₹15,00,000

- Total Equity: ₹25,00,000

Debt-to-Equity Ratio:

- Formula: Debt-to-Equity Ratio = Total Debt / Total Equity

- Calculation: Debt-to-Equity Ratio = ₹15,00,000 / ₹25,00,000 = 0.6

- Interpretation: A ratio of 0.6 means the company has ₹0.60 in debt for every ₹1 in equity, indicating a moderate level of debt.

Example 2: Calculating the Return on Assets (ROA)

Company DEF's Financial Figures:

- Net Income: ₹4,00,000

- Average Total Assets: ₹40,00,000

Return on Assets (ROA):

- Formula: ROA = (Net Income / Average Total Assets) * 100

- Calculation: ROA = (₹4,00,000 / ₹40,00,000) * 100 = 10%

- Interpretation: A 10% ROA means the company earns ₹0.10 for every ₹1 in assets, showing efficient use of assets to generate profit.

Why Ratio Analysis Matters

Ratio analysis helps investors, managers, and stakeholders understand a company's financial health. It shows how well the company manages its assets, liabilities, and equity, and how profitable it is.

Common Ratios to Know

- Current Ratio: Measures liquidity. High current ratios are good.

- Debt-to-Equity Ratio: Assesses financial leverage. Lower ratios indicate less debt.

- Net Profit Margin: Shows profitability. Higher margins are better.

- Return on Assets (ROA): Indicates efficiency. Higher ROA means better asset use.

Types of Financial Statements

Understanding the Balance Sheet: A Fundamental Financial Statement

What is a Balance Sheet?

The balance sheet is like a snapshot of a company's financial health at a specific moment.

It shows what the company owns (assets), what it owes (liabilities), and the owner's equity.

Key Components:

1. Assets:

Example: If a company has ₹5,00,000 in cash, ₹3,00,000 in inventory, and ₹2,00,000 owed to them by customers, their current assets total ₹10,00,000.

Example: A company owns a building worth ₹50,00,000 and machinery worth ₹10,00,000.

2. Liabilities:

Example: If a company owes ₹2,00,000 to suppliers and has a short-term loan of ₹1,00,000, its current liabilities total ₹3,00,000.

Example: A company has a loan of ₹20,00,000 that needs to be repaid over five years.

3. Owner's Equity:

Example: If a company has total assets of ₹60,00,000 and total liabilities of ₹23,00,000, the owner's equity is ₹37,00,000.

Example of Balance Sheet:

- Assets: ₹60,00,000 (Current Assets: ₹10,00,000 + Fixed Assets: ₹50,00,000)

- Liabilities: ₹23,00,000 (Current Liabilities: ₹3,00,000 + Long-Term Liabilities: ₹20,00,000)

- Owner's Equity: ₹37,00,000

Income Statement Analysis: Key Components and Metrics

What is an Income Statement?

The income statement shows a company’s performance over a specific period, like a movie showing how the company earned and spent money.

Key Components:

1. Revenue:

- The total income from sales of goods or services.

- Example: If a company sells goods worth ₹20,00,000 in a year, that’s its revenue.

2. Expenses:

- The costs incurred to generate the revenue. Includes cost of goods sold (COGS), operating expenses, interest, and taxes.

- Example: If the company spent ₹5,00,000 on buying goods (COGS), ₹3,00,000 on salaries, ₹2,00,000 on rent and utilities, and ₹1,00,000 on taxes, the total expenses are ₹11,00,000.

3. Net Profit (or Loss):

- The remaining money after subtracting total expenses from total revenue.

- Example: If the revenue is ₹20,00,000 and total expenses are ₹11,00,000, the net profit is ₹9,00,000.

Example of Income Statement:

- Revenue: ₹20,00,000

- Expenses: ₹11,00,000 (COGS: ₹5,00,000 + Salaries: ₹3,00,000 + Rent and Utilities: ₹2,00,000 + Taxes: ₹1,00,000)

- Net Profit: ₹9,00,000

Cash Flow Statement: Tracking Financial Movements

What is a Cash Flow Statement?

The cash flow statement shows how cash enters and leaves a company during a specific period. It focuses on cash transactions only.

Key Components:

1. Operating Activities:

- Cash generated or spent from regular business operations.

- Example: If a company receives ₹15,00,000 from sales and spends ₹7,00,000 on operating expenses, the net cash from operating activities is ₹8,00,000.

2. Investing Activities:

- Cash used in buying or selling long-term assets.

- Example: If a company buys new machinery for ₹3,00,000, this is a cash outflow from investing activities.

3. Financing Activities:

- Cash received from or paid to investors and creditors.

- Example: If a company takes a loan of ₹5,00,000 and pays dividends of ₹1,00,000, the net cash from financing activities is ₹4,00,000.

Example of Cash Flow Statement:

- Operating Activities: ₹8,00,000

- Investing Activities: -₹3,00,000

- Financing Activities: ₹4,00,000

- Net Increase in Cash: ₹9,00,000

Free Cash Flow and Other Valuation Statements: Their Importance

What is Free Cash Flow?

Free cash flow is the cash a company generates after accounting for cash outflows to support operations and maintain capital assets. It’s important because it shows how much cash is available for expansion, paying dividends, or reducing debt.

Key Components of Free Cash Flow:

1. Calculation of Free Cash Flow:

- Free Cash Flow = Net Cash from Operating Activities - Capital Expenditures

- Example: If a company’s net cash from operating activities is ₹10,00,000 and capital expenditures are ₹2,00,000, the free cash flow is ₹8,00,000.

2. Importance of Free Cash Flow:

- Shows the company’s ability to generate cash and fund growth.

- Indicates financial health and efficiency in managing capital.

Example Calculation:

- Net Cash from Operating Activities: ₹10,00,000

- Capital Expenditures: ₹2,00,000

- Free Cash Flow: ₹8,00,000

Other Valuation Statements:

- Valuation Statements help determine the value of the company. These include earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE).

- Example: If a company has an EPS of ₹50 and the stock price is ₹500, the P/E ratio is 10 (500/50).

Financial Performance

Measuring Financial Performance: Key Indicators and Metrics

What does Financial Performance Measure?

Financial performance measures how well a company uses its resources to generate profit. It's like checking your report card at the end of the year to see how well you did.

Key Indicators of Financial performance measures:

1. Revenue:

This is the total money a company earns from selling its products or services. For example, if a bakery sells 1,000 loaves of bread at ₹20 each, its revenue is ₹20,000.

2. Profit:

Profit is what's left after subtracting all expenses from revenue. Using the bakery example, if the total expenses (like ingredients, rent, and salaries) are ₹15,000, the profit is ₹5,000 (₹20,000 - ₹15,000).

3. Expenses:

These are costs a company incurs to run its business. Common expenses include rent, salaries, and utilities. If the bakery spends ₹5,000 on ingredients and ₹10,000 on other costs, its total expenses are ₹15,000.

4. Net Profit Margin:

This tells how much profit a company makes for every rupee of revenue. If the bakery has a profit of ₹5,000 from ₹20,000 in revenue, the net profit margin is 25% (₹5,000/₹20,000 x 100).

Other Metrics in Financial Performance Measures:

1. Return on Investment (ROI):

ROI measures how well an investment performs. If the bakery invested ₹10,000 in new equipment and earned an additional ₹2,000 in profit, the ROI is 20% (₹2,000/₹10,000 x 100).

2. Debt-to-Equity Ratio:

This ratio shows how much debt a company has compared to its equity (owner's money). If the bakery has ₹50,000 in debt and ₹100,000 in equity, the ratio is 0.5 (₹50,000/₹100,000).

What Are the Advantages of Financial Statement Analysis?

Financial statement analysis helps understand a company's financial health, similar to how a health check-up gives insights into your body's well-being.

Advantages of Financial Statement Analysis:

1. Informed Decision-Making:

It helps business owners make better decisions. For example, if a bakery owner sees that ingredient costs are too high, they can find cheaper suppliers to increase profit.

2. Identifying Trends:

Analyzing financial statements over time can reveal trends. If a bakery's profit has increased every year, it shows the business is growing.

3. Assessing Performance:

It helps assess how well the company is performing. If the bakery's expenses are increasing faster than revenue, it indicates a problem.

4. Securing Loans:

Banks use financial statements to decide whether to give loans. A bakery with strong financial statements is more likely to get a loan for expansion.

5. Attracting Investors:

Investors want to see financial statements before investing. If the bakery shows good financial health, investors are more likely to invest.

Different Types of Financial Statement Analysis Explained

There are different ways to analyze financial statements, each giving unique insights into a company's performance.

What are the Types of Financial Statement Analysis?

These are some types of Financial Statement Analysis

1. Horizontal Analysis:

Compares financial data over multiple periods. For example, if the bakery's revenue was ₹20,000 last year and ₹25,000 this year, the increase is ₹5,000.

2. Vertical Analysis:

Compares each item in a financial statement to a base number. In a profit and loss statement, it compares each expense to total revenue. If the bakery's rent is ₹2,000 out of ₹20,000 revenue, it's 10%.

3. Ratio Analysis:

Uses ratios to evaluate financial performance. For example, the profit margin ratio shows profit as a percentage of revenue. If the bakery has a profit of ₹5,000 and revenue of ₹20,000, the profit margin is 25%.

4. Trend Analysis:

Looks at financial data over time to identify patterns. If the bakery's revenue has increased by 10% every year, that's a positive trend.

Real-World Examples of Financial Statement Analysis

1. Balance Sheet Analysis

A balance sheet shows a company's assets, liabilities, and equity at a specific point in time.

Example:

Imagine a small grocery store. Here's a simplified balance sheet:

1. Assets:

- Cash: ₹50,000

- Inventory: ₹1,00,000

- Equipment: ₹2,00,000

2. Liabilities:

- Loans: ₹1,00,000

- Accounts Payable: ₹50,000

3. Equity:

- Owner's Equity: ₹2,00,000

Analysis:

The store's total assets are ₹3,50,000 (₹50,000 + ₹1,00,000 + ₹2,00,000). Its total liabilities are ₹1,50,000 (₹1,00,000 + ₹50,000). The owner's equity is ₹2,00,000, showing the owner has invested a significant amount.

2. Income Statement Analysis

An income statement shows the company's revenue, expenses, and profit over a period.

Example:

Consider a small bakery:

- Revenue: ₹5,00,000

- Expenses:

- Ingredients: ₹1,50,000

- Rent: ₹1,00,000

- Salaries: ₹1,00,000

- Utilities: ₹50,000

Profit Calculation:

Revenue (₹5,00,000) - Expenses (₹4,00,000) = Profit (₹1,00,000)

Analysis:

The bakery earned ₹5,00,000 in sales and spent ₹4,00,000 on expenses, resulting in a profit of ₹1,00,000. This profit indicates the bakery is doing well.

3. Cash Flow Statement Analysis

A cash flow statement shows how cash moves in and out of the business.

Example:

Look at a small tech company:

Cash Inflows:

- Sales: ₹10,00,000

- Investments: ₹2,00,000

Cash Outflows:

- Salaries: ₹3,00,000

- Rent: ₹1,00,000

- Equipment Purchase: ₹4,00,000

Net Cash Flow Calculation:

Cash Inflows (₹12,00,000) - Cash Outflows (₹8,00,000) = Net Cash Flow (₹4,00,000)

Analysis:

The company received ₹12,00,000 and spent ₹8,00,000, leaving a positive net cash flow of ₹4,00,000. This positive cash flow means the company has enough cash to cover its expenses and invest in growth.

4. Ratio Analysis

Ratios help compare different aspects of a company's financial performance.

Example:

Consider a small retail store. Let's calculate the current ratio (Current Assets / Current Liabilities):

- Current Assets: ₹1,50,000

- Current Liabilities: ₹75,000

Current Ratio Calculation:

Current Ratio = ₹1,50,000 / ₹75,000 = 2

Analysis:

The current ratio of 2 means the store has twice as many current assets as current liabilities. This indicates a strong ability to pay off short-term debts.

5. Real-World Case Study: Tata Motors

Tata Motors is a well-known Indian automobile company. Let's analyze its financial statements:

Balance Sheet Highlights (2023):

- Assets: ₹5,00,000 crore

- Liabilities: ₹3,50,000 crore

- Equity: ₹1,50,000 crore

Income Statement Highlights (2023):

- Revenue: ₹3,00,000 crore

- Expenses: ₹2,80,000 crore

- Profit: ₹20,000 crore

Analysis:

Tata Motors has substantial assets and equity, indicating a solid financial position. The company earned ₹3,00,000 crore in revenue and made a profit of ₹20,000 crore, showing profitability.

Cash Flow Highlights (2023):

- Cash Inflows: ₹50,000 crore

- Cash Outflows: ₹40,000 crore

- Net Cash Flow: ₹10,000 crore

Analysis:

Tata Motors generated a positive net cash flow of ₹10,000 crore, which is a good sign of financial health.

Conclusion

Financial statement analysis provides valuable insights into a company's financial health. By examining real-world examples like a grocery store, bakery, tech company, retail store, and Tata Motors, we can see how balance sheets, income statements, cash flow statements, and ratio analysis help us understand a company's performance and make informed decisions.